Problem Definition

An

important question in Finance is whether or not the stock market is efficient.

The market is efficient if knowledge of past information or changes in a

stock’s price tells us nothing about future changes in a stock’s price. In

order to test market efficiency, the historical data of IBM’s daily stock

return during 1994 is used. Then the data of the return on IBM during the last

five days is used to predict tomorrow’s return. To see if the last five days

can be used to predict today’s return, regression analysis is performed. If the

market is efficient, the data from the last five days cannot be used to predict

tomorrow’s return.

Data Collection

First, we

need to collect the data. The collection process is done in a simple way in

that it can be downloaded from any financial source website, such as Yahoo.

Second, the return can be simply calculated using the formula (Pt/Pt-1)

- 1. Click here to get the data file.

Model Formulation

Let’s see

if daily price changes in IBM during 1994 are consistent with efficient

markets. We want to determine if knowing that IBM went up yesterday or down

yesterday would help us determine whether IBM will go up or down today. We

would like to know the fraction of the time IBM goes up today after going down

yesterday and the fraction of the time IBM goes up today after going up

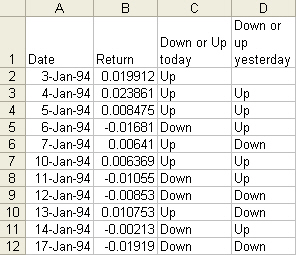

yesterday. The following is the example of the input data:

The data is

analyzed using PivotTable. A

PivotTable report is an interactive worksheet table that quickly combines and

compares large amounts of data. Basically, it summarizes large amount of data

using calculation methods you choose. You can rotate its rows and columns to

see different summaries of the source data, and you can display the details for

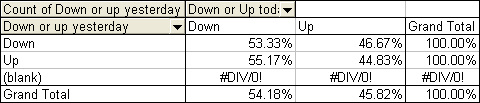

areas of interest. After sorting out the table, it should look as follow:

The figure above

makes it clear that how IBM did yesterday has little effect on how it does

tomorrow. If IBM went down yesterday it has a 53% chance of going down today,

while if IBM went up yesterday it has a 55% chance of going up today. Since 53%

and 55% are close, what happened yesterday appears to have little effect on

what will happen today. This is consistent with the efficient market hypothesis of finance.

Time-series forecasting

Time-series forecasting is a collection of methods used to predict future

outcomes based upon historical values. Time series analysis is an integral part

of financial analysis that is interesting and useful, with applications to the

prediction of interest rates, foreign currency risk, stock market volatility,

and the like. In this project, we use regression to look for market efficiency.

Regression is used to estimate the

value of one variable when other variables are known.

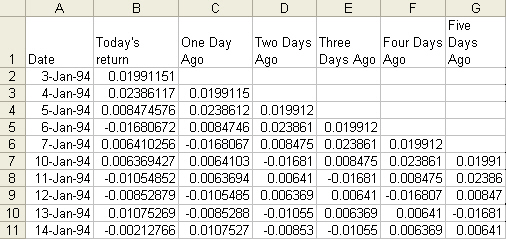

The next step is

to use regression to look for market inefficiencies. First, the independent

variables must be identified. The dependent variable is today’s return and the

independent variables are the last five days of IBM returns. The input data

should look as follow:

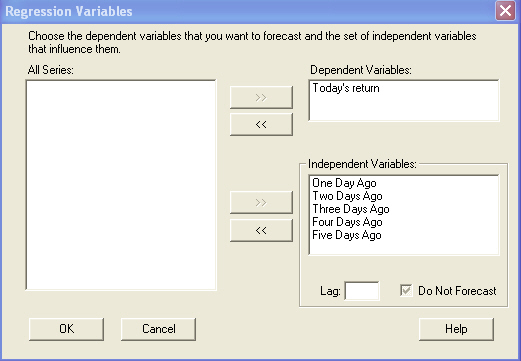

We are

now ready to use CB Predictor

to run the regression analysis. CB Predictor is just another time-series

forecasting tool for Excel. It is a fully integrated Excel function that uses

goodness of fit measures (RMSE, MAD or MAPE) and ranks the fits from best to

worst. First, it will individually forecast the independent variables (in this

case, the last five days returns) and then forecast the dependent variable

(today’s return) using multiple regression.

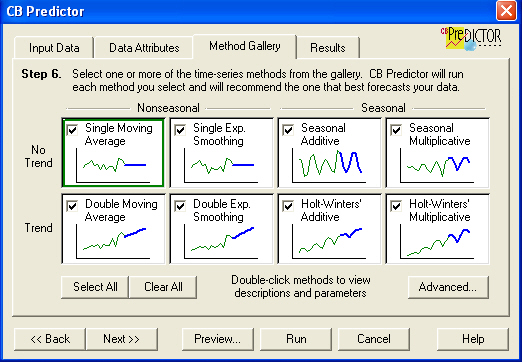

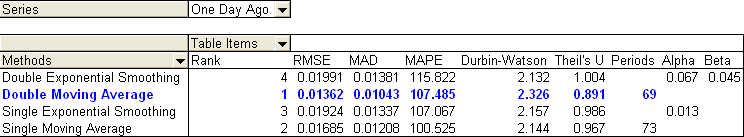

CB

Predictor lets us forecasts multiple series of historical data at once using

any of eight time-series forecasting methods shown below, including additional

seasonal methods. We can forecast all the series, trying all the methods for

each one. It will then tell us which method works best for each, according to

one of the three error measures (RMSE, MAD, and MAPE).

|

Summary: |

|

|

|

|

|

|

|

|

Number of series: 6 |

|

|

|

|

|

|

|

Periods to forecast: 4 |

|

|

|

|

|

|

|

Seasonality: none |

|

|

|

|

|

|

|

Error Measure: RMSE |

|

|

|

|

|

|

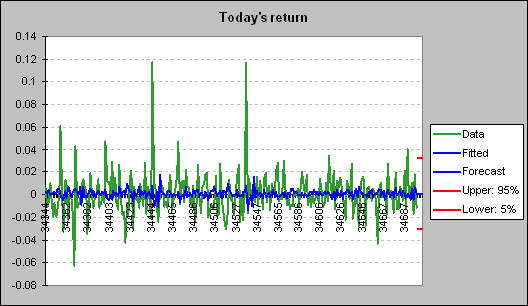

Series: Today's return |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Method: Multiple

Linear Regression |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Statistics: |

|

|

|

|

|

|

|

|

R-squared: 0.038 |

|

|

|

|

|

|

|

Adjusted R-squared: 0.01799 |

|

|

|

|

|

|

|

SSE: 0.08575 |

|

|

|

|

|

|

|

F Statistic: 1.9016 |

|

|

|

|

|

|

|

F Probability: 0.09474 |

|

|

|

|

|

|

|

Durbin-Watson: 2.001 |

|

|

|

|

|

|

|

No. of Values: 247 |

|

|

|

|

|

|

|

Independent variables: 5 included out of 5

selected |

||||

|

|

|

|

|

|

|

|

|

|

Series Statistics: |

|

|

|

|

|

|

|

|

Mean: 0.001142479 |

|

|

|

|

|

|

|

Std. Dev.: 0.019035226 |

|

|

|

|

|

|

|

Minimum: -0.06278027 |

|

|

|

|

|

|

|

Maximum: 0.1172249 |

|

|

|

|

|

|

|

Ljung-Box: 138.1209 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Forecast: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

Lower:

5% |

|

Forecast |

Upper:

95% |

|

|

|

|

-0.029841488 |

|

0.001314582 |

0.032470651 |

|

|

|

|

-0.02996433 |

|

0.001318907 |

0.032602144 |

|

|

|

|

-0.030088215 |

|

0.001323232 |

0.03273468 |

|

|

|

|

-0.030213154 |

|

0.001327558 |

0.03286827 |

|

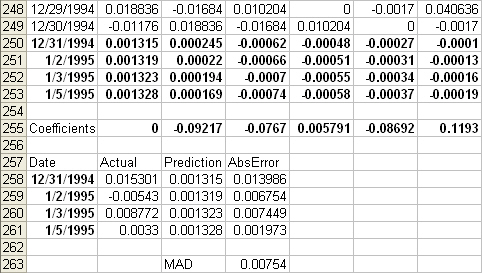

Regression Variables: |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Variable |

|

|

Coefficient |

t

Statistic |

Probability |

|

|

Constant |

|

|

0.001281 |

1.053 |

0.2934 |

|

|

One Day Ago |

|

|

-0.09217 |

-1.4401 |

0.1511 |

|

|

Two Days Ago |

|

|

-0.0767 |

-1.1976 |

0.2322 |

|

|

Three Days Ago |

|

|

0.005791 |

0.09007 |

0.9283 |

|

|

Four Days Ago |

|

|

-0.08692 |

-1.3604 |

0.175 |

|

|

Five Days Ago |

|

|

0.1193 |

1.8705 |

0.06262 |

Interpretation:

The R square value of 0.038 means that the

last five days of return explains only approximately 4% of the variation in today’s returns.

The

equation for forecasting today’s IBM return would be:

Today’s

return = .01281 –.09217(1 day ago) -.0767(2 days ago) + .005791(3 days ago)

-.08692(4 days ago) + .1193(5 days ago)

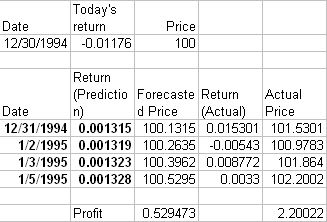

Predicted

results:

The

number of periods predicted = 4 (December 31, 1994 – January 5, 1995). The

model tells us that the predicted return for IBM stock on

CB

Predictor is useful in that it also forecasts each of the independent

variables. The result of the forecasted first independent variable (one day

ago) or first series is shown below:

|

Series: One Day Ago |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Method: Double Moving Average |

|

|

|

||

|

|

Parameters: |

|

|

|

|

|

|

|

|

Periods:

69 |

|

|

|

|

|

|

Error: 0.01362 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series Statistics: |

|

|

|

|

|

|

|

|

Mean: 0.001216062 |

|

|

|

|

|

|

|

Std. Dev.: 0.019020251 |

|

|

|

|

|

|

|

Minimum: -0.06278027 |

|

|

|

|

|

|

|

Maximum: 0.1172249 |

|

|

|

|

|

|

|

Ljung-Box: 138.7442 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Forecast: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

Lower:

5% |

|

Forecast |

Upper:

95% |

|

|

|

|

-0.022246491 |

|

0.000245203 |

0.022736897 |

|

|

|

|

-0.022363808 |

|

0.000219689 |

0.022803185 |

|

|

|

|

-0.022481878 |

|

0.000194174 |

0.022870226 |

|

|

|

|

-0.02260071 |

|

0.00016866 |

0.022938029 |

Suppose

on

In conclusion, time-series analysis is vital in every aspect of business as it has its interesting and useful applications in such disparate fields as marketing, finance, and organizational behavior. It is important to be mindful that, despite the importance of the model, it is in fact only a representation of reality and not the reality itself. Accordingly, the model must adapt to reality; it is futile to attempt to adapt reality to the model.