|

||

|

||||||

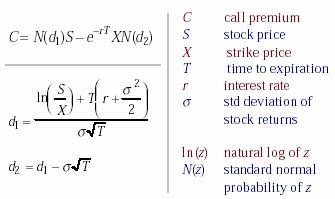

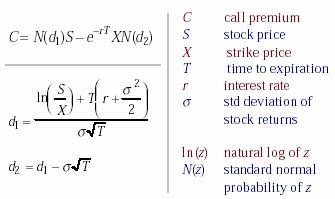

| Using Black-Scholes Option Formula to Find the Put Price | |||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||

| Input data | |||||||||||||||||||||||||||||||||||

| Stock price (S) | $94.25 | today | 6/30/1998 | 35976 |

|

DATEVALUE("6/30/98") | |||||||||||||||||||||||||||||

| Exercise price (X) | $80 | expire | 11/22/1998 | 36121 |

|

DATEVALUE("11/22/98") | |||||||||||||||||||||||||||||

| Duration (t) | 0.39726 | difference | 145.00 | ||||||||||||||||||||||||||||||||

| Interest rate (r) | 5.35% |

|

|||||||||||||||||||||||||||||||||

| Implied volatility (s) | 53.43% | ||||||||||||||||||||||||||||||||||

| d1 | 0.71833 | N(d1) | 0.763723 |

|

|||||||||||||||||||||||||||||||

| d2 | 0.381589 | N(d2) | 0.648617 | ||||||||||||||||||||||||||||||||

| Call price (C) | $21.18 | ||||||||||||||||||||||||||||||||||

| Put price (P) | $5.25 |

|

Xe-rt N(-d2) - SN(-d1) | ||||||||||||||||||||||||||||||||

|

C = N(d1)S - e-rT XN(d2 ) | ||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||